Hire Hidden Tech Talent

50% Faster Than Other Recruiters

AmazingHiring combines advanced search across 50+ networks, contact info, outreach campaigns, messaging, and analytics – so you can hire the best talent faster, smarter, and easier.

Trusted by 500+ talent acquisition teams

Features That Transform Your Hiring

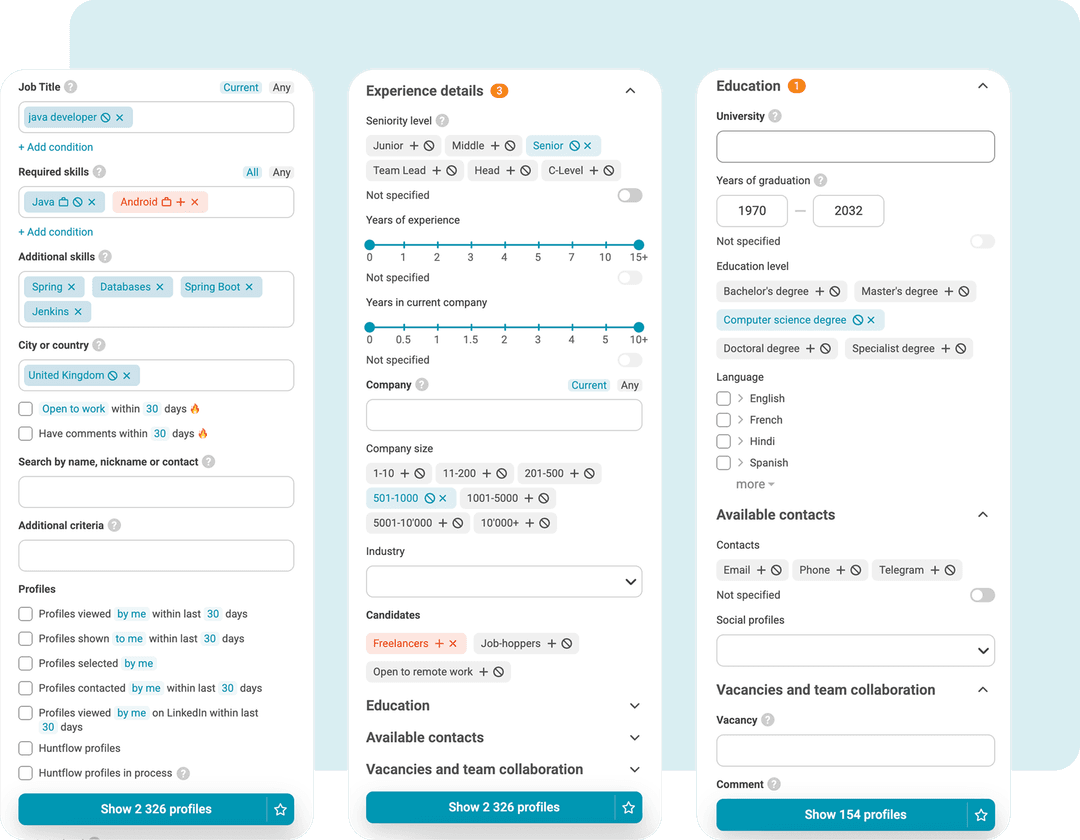

Recruiters waste hours switching between multiple platforms and complex Boolean searches.

Use AmazingHiring, an all-in-one talent sourcing platform, to source candidates across GitHub, StackOverflow, Kaggle, LinkedIn, and more with just a few clicks. Filter by skills, experience, open-to-work status, location, and more.

Save hours of manual searching and discover hidden talent faster.

“To find suitable talent before AmazingHiring, we'd have to divide our time between multiple different tools like CV Library, LinkedIn, Jobsite. AmazingHiring helps us to save time and effort on sourcing the right kind of talent for our partners”

Chrome Extension

Install the Chrome extension designed for IT recruiters. It activates on the candidate's profile and displays links to all their social media accounts.

Install for freeWhy TA Leaders love

AmazingHiring

Why Our Customers

Trust Us

Amazing Hiring is my go-to tool when starting any search globally - the ease of use and ability to search across multiple different social and professional networks make it the top tool of my sourcing technology stack

We have crazy demand for Java developers. AmazingHiring helps my team achieve our hiring KPIs. The most valuable feature for me is smart filters for search queries

I would recommend AmazingHiring to my colleagues for 2 reasons: firstly, it’s the most comprehensive tech recruiting tool out there today, and, secondly, service level is super high!

With the help of AmazingHiring we are able to source candidates on the non-obvious resources. And thanks to that, our response rate is higher than 55%

Our tech sourcing strategy starts with AmazingHiring — we use the platform immediately as it works in the background through automation

AmazingHiring aggregates search results from multiple platforms and saves time spent on hiring process. It helped me complete 5-7 projects instead of 1-2 in the same amount of time

Get started today

Whether you’re scaling a team or filling hard-to-hire roles, AmazingHiring gives you the tools to make smarter hiring decisions.

Schedule your demo today and see how AmazingHiring can help you hire the best talent faster, smarter and easier!